Capital One Binding Arbitration

Find tips for managing money and more from wherever you are.

Capital one binding arbitration. Meet eno your capital one assistant. The consumer is required to waive their right to sue to participate in a class action lawsuit or to appeal. Sign in to access your capital one account s. The period expired in 2013.

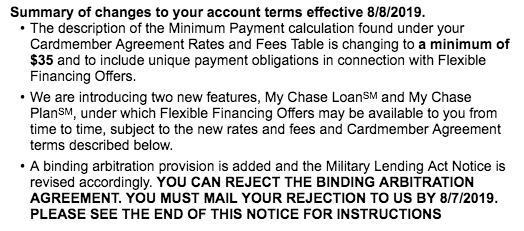

In binding mandatory arbitration a company requires a consumer to agree to submit any dispute that may arise to binding arbitration prior to completing a transaction with the company. For claims of more than 10 000 it s 375 or more naimark says. We re more than just a bank. How binding arbitration works.

The overwhelming majority of cases involve consumers with unpaid bills typically between 5 000 and 20 000. Credit card agreement for cabela s club cards in capital one bank usa n a. Eno is at work 24 7 looking out for charges that might surprise you and helping you fix them. In december 2009 capital one joined in the retreat and bank of america took its action.

Fairshake helps make this process easy and convenient. Read about topics that matter to you. In a settlement several years ago some issuers including bank of america capital one and chase entered a moratorium on arbitration clauses which has since expired says myriam gilles professor. For arbitration association cases involving less than 10 000 the fee is 125.

It lets you argue your case before an independent arbitrator who can force the credit card provider to fix the problem and compensate you. Once an arbitrator is selected by the firm you ll. Among major card issuers chase capital one and bank of america agreed to give up their credit card arbitration clauses for a period as part of a 2009 settlement of anti trust claims. 232 kb pdf credit card agreement for kohl s cards in capital one n a.

205 kb pdf credit card agreement for buypower cards in capital one n a. 241 kb pdf credit card agreement for gm extended family card in capital one n a. So far capital one and bank of america have continued to leave the clause out of their credit card contracts.